The way India does business will change forever after the GST bill is rolled out and we at RNR understand that there will be unparalleled changes to your business irrespective of it being a small business or an enterprise.

India's GST implementation is expected to bring the unorganized sector under a uniform tax base and improve growth opportunities for the organized sector. In the long run, this is expected to unburden the common man and the SME's as well. Implementation of GST will lead to 36-60 billion invoice uploads every year. Hence to tackle this huge number of new data RnR's Rujul ERP has been well equipped to deal with the individualized needs of each and every customer. Are you GST ready? each and every customer. Are you GST ready?

Financial Year 2017-18 will be defining year for India, with the advent of much awaited Goods and Services Tax (GST) reform. GST is expected to have a far reaching and wide impact on business, society and general economy. It is also expected to address the current issue of inefficiencies in the tax system, prevent cascading impact of multi-level taxation, plug the revenue leakages and raise the transparency levels in business. Smooth transition to the GST is one of the top 3 agenda items on our strategy and execution list. With GST, the past no longer holds good and future is laden with number of implementation challenges.

GST is also expected to significantly impact all key business processes, be it Procurement to Pay (P2P), Record to Report (R2R), Order to Cash (O2C) and Budgeting and Planning. To ensure smooth transition of all key business processes through the wave of GST, it is critical for all organizations to be ready with a cutting edge technology solution, like we provide at RnR. The GST regime will have significant influence not only on large business houses, but also on the Micro, Small and Medium Enterprises sector (MSME). Non/under recording/reporting of purchase and sales transactions, fragmentation in the methods.

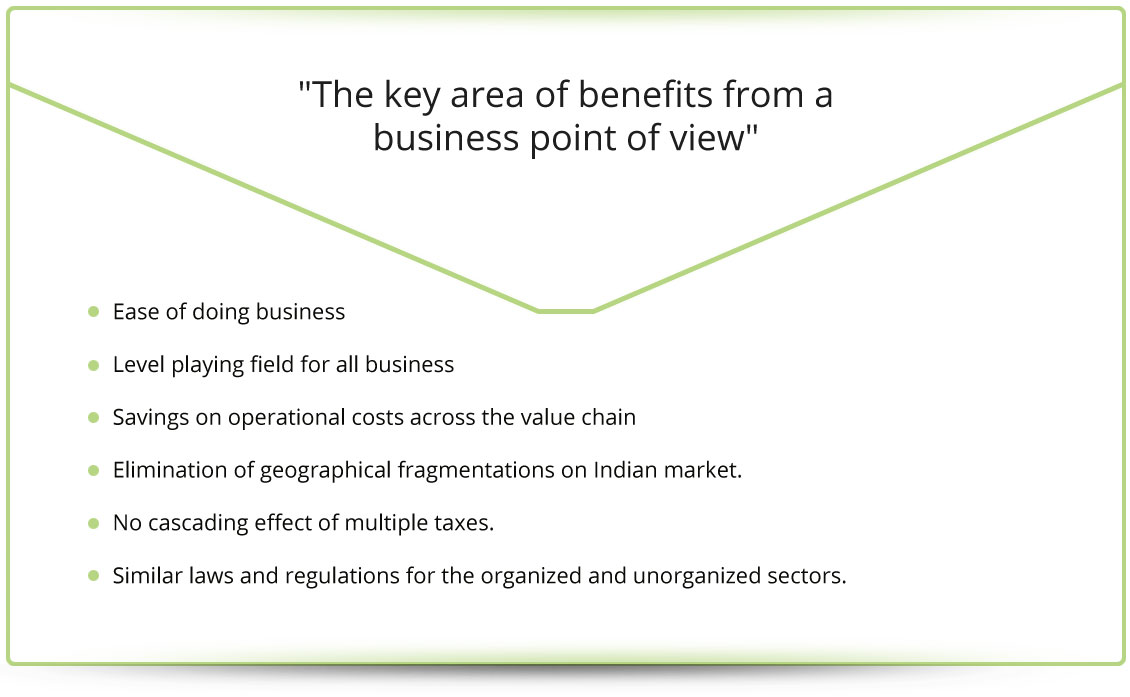

The implementation of GST is expected to bring multiple benefits for various types of business entities in India, consumer as well as Government both at center and state level will benefit from the implementation of GST. With GST coming into play, the current indirect tax structure existing in India will undergo change, which broadly will be:

GST will require multiple changes in the business operations. Companies will need to scale up the technology infrastructure for ensuring high level of vendor tax compliances, system to maintain adequate level of vendor database, review of the compliances at supplier's end, monitor the periodicity of the tax payments and filings. RUJUL ERP qualifies the businesses in smooth transition in high level compliance oriented GST environment and is capable of administration of complex tax configurations and high volumes of vendor compliance level management.

GST has widespread implications for businesses in primarily two major areas, which are Compliances and Business Operations:

ComplianceWith GST subsuming multiple Central and State taxes, uniform tax regime will drive restructuring of pricing and dealer margins. Pass through effect of taxes will come in and some benefit might be passed on to the channel and/or to the consumer. Price changes and competitor actions will have an integrated and direct correlation to volume/market share with an effect across India, making real time pricing strategies a key part of strategic decision making.

Organisations are seeking practical solutions to numbers of questions and challenger related to key business operations that include:

| Business Challenges | Solution Through Rujul ERP |

| Where do we stand today and how to build a roadmap for GST implementation. | Our expert Business Analysis team will quickly Analyse the current situation and draw a well thought out plan for hiccup free transition |

| What will be the major business changes? | Organizations with large unstructured data will gain significant efficiency in transaction recording and processing. |

| How to consolidate the erstwhile Tax structure in the current ERP and other supporting business applications to align with the new structure? | High level of business process, structures and database integration capabilities. Rujul ERP removes the burden of maintaining separate legacy systems and fragmented data, so you can run live and make better business decisions in the new digital economy. |

WHAT DO YOU NEED TO SUCCEED?

WHO WILL SUCCEED THROUGH THE GST?

While there will be implementation challenges, the business that quickly identifies and prepares for the changes, will be gaining a significant and sustainable competitive advantage, much ahead of its industry peers. To do so, businesses need a solid implementation plan and a trusted technology partner.

Alcohol for human consumption, Petroleum Products viz. petroleum crude, motor spirit (petrol), high speed diesel, natural gas and aviation turbine fuel& Electricity. Learn more.

No. Every person who is liable to take a Registration will have to get registered separately for each of the States where he has a business operation and is liable to pay GST in terms of Sub-section (1) of Section 19 of Model GST Law. Learn more.

The taxable event under GST shall be the supply of goods and / or services made for consideration in the course or furtherance of business. The taxable events under the existing indirect tax laws such as manufacture, sale, or provision of services shall stand subsumed in the taxable event known as 'supply'. Learn more.

Every registered taxable person has to furnish outward supply details in Form GSTR-1 (GST Returns-1) by the 10th of the subsequent month. On the 11th, the visibility of inward supplies is made available to the recipient in the auto-populated GSTR-2A. The period from 11th to 15th will allow for any corrections (additions, modifications and deletion) in Form GSTR-2A and submission in Form GSTR-2 by 15th of the subsequent month.The corrections (addition, modification and deletion) by the recipient in Form GSTR-2 will be made available to supplier in Form GSTR-1A. The supplier has to accept or reject the adjustments made by the recipient. The Form GSTR-1 will be amended according to the extent of correction accepted by supplier.

On 20th, the auto-populated return GSTR-3 will be available for submission along with the payment. After the due date of filing the monthly return Form GSTR-3, the inward supplies will be matched with the outward supplies furnished by supplier, and then the final acceptance of input tax credit will be communicated in Form GST ITC-1.

Also, the mismatch input tax credit on account of excess claims or duplication claims will be communicated in Form GST ITC-1. Discrepancies not ratified will be added as output tax liability along with interest. However, within the prescribed time, if it is ratified, the recipient will be eligible to reduce this output tax liability. Learn more.