The Reserve Bank of India has given its permission to all the loan providing institutes to offer a moratorium to their borrowers, effective from March till May. This order was passed keeping in mind the pandemic situation that has caused huge chaos in the country. Impacting the lives of several individuals and businesses.

What is a three-month moratorium ?

The three-month moratorium means a borrower doesn’t have to pay the loan EMI instalments during the moratorium period. However, you will have to pay additional interest for three months (for deferring equated monthly instalment (EMIs)) to your lender.

This is applicable to credit cards of an individual as well. Plus, this won’t cause a downfall at the borrower’s credit rating or affect the risk classification of the loan. If the borrower has taken a loan that specifies any terms related to the moratorium even that would be applicable depending on the moratorium policy adopted by the lending institution.

The three options to pay the interest

- Either increase the loan period without increasing your EMI amount.

- Increase the EMI amount without having to increase the tenure.

- Make the deferring amount of March, April & May all at once in June.

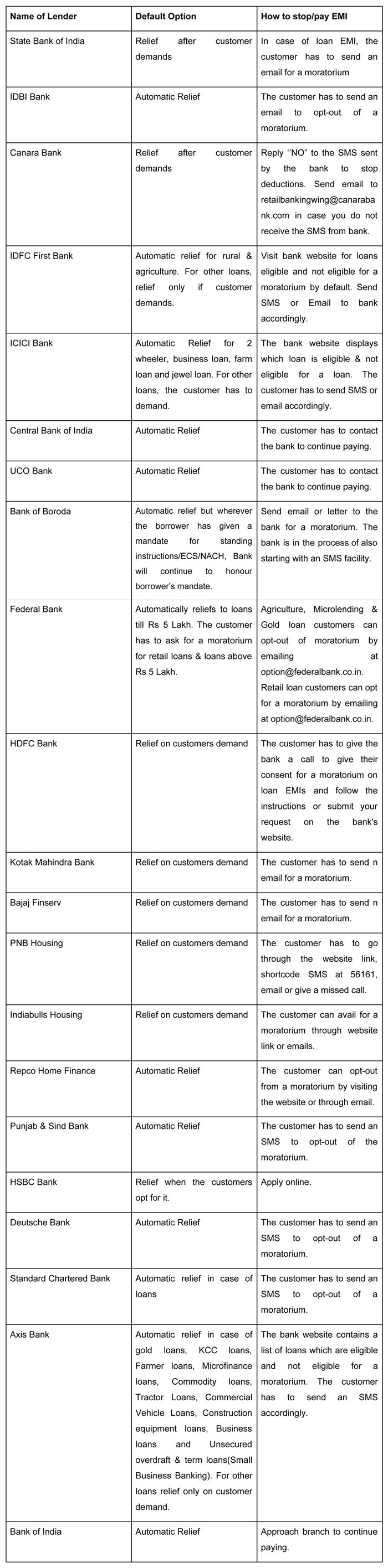

While few banks are asking their borrowers if they want to opt for a moratorium, the remaining few have automatically opted for a moratorium by default. The following banks and NBFC’s are asking their borrowers if they want to avail the loan repayment moratorium, which are choosing the default ‘opt-in’ option and which will offer the moratorium only if the borrower asks for it on their own.